Sustainable farming practices are gaining traction, but acquiring the necessary equipment, like a new tractor, can be a significant financial hurdle. Securing the right financing is crucial for success. For more in-depth information, check out this helpful guide on tractor financing options. This guide provides a step-by-step approach to navigating the complexities of tractor financing, empowering you to make informed decisions and invest in a sustainable future for your farm.

Understanding Tractor Financing

Before diving into the specifics, let's clarify some common terms. Tractor financing is essentially borrowing money to purchase a tractor. Key terms include:

- APR (Annual Percentage Rate): The yearly interest cost of your loan (like the "rent" for borrowing).

- Loan Term: The length of time you have to repay the loan (longer terms mean smaller monthly payments but more interest overall).

- Interest Rate: The percentage charged annually on the borrowed amount.

- Down Payment: The initial amount you pay upfront, reducing the loan amount.

Isn't it crucial to understand these before you start the process? Many farmers find themselves in unexpected situations due to a lack of financial literacy.

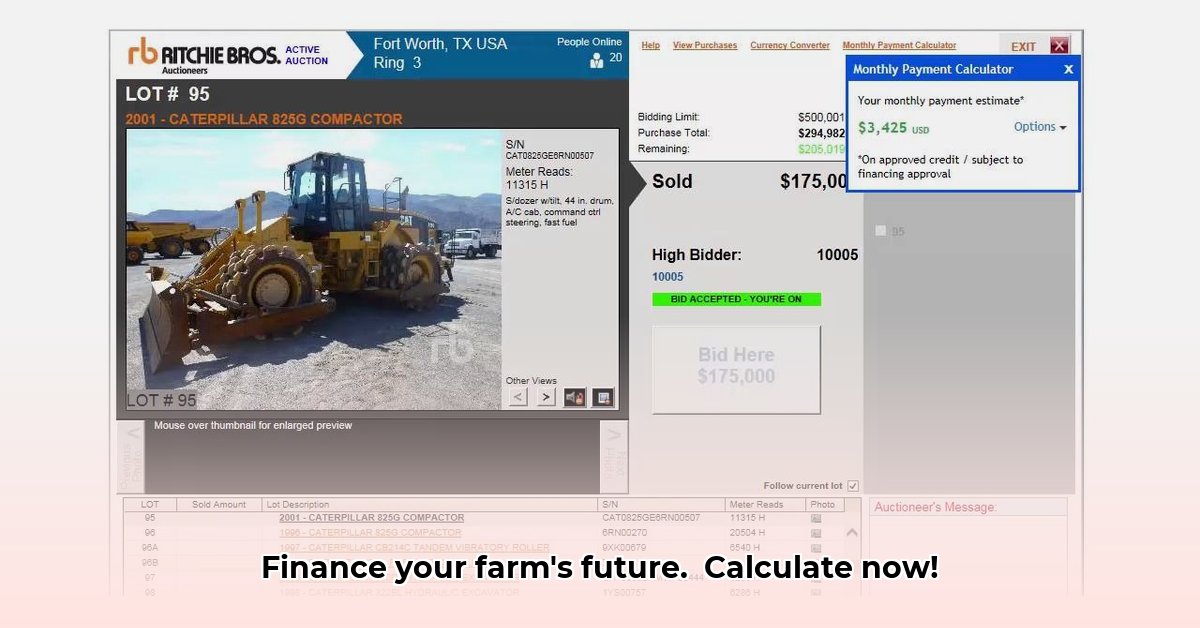

Using Online Tractor Financing Calculators

Online tractor financing calculators provide preliminary estimates of monthly payments and total interest costs. While helpful, they're not a substitute for personalized quotes. Think of them as a recipe – they give you ingredients, but you still need to do the baking.

Step-by-Step Guide:

- Find a Reliable Calculator: Search for "tractor financing calculator" on reputable financial or agricultural websites. Avoid lesser-known sites that might offer inaccurate or misleading information. (Remember to check reviews before you trust any website)

- Input Your Data: Enter the tractor's price, desired loan length, interest rate, and any down payment. Accuracy is vital for precise estimates.

- Analyze the Results: The calculator will display your estimated monthly payment, total interest paid, and overall cost. Remember, these are only estimations.

- Compare Results: Use several calculators with the same data to see the range of possible outcomes. This helps in getting a better understanding of the market.

Did you know that using multiple calculators can significantly increase the accuracy of your estimate? Many farmers miss this critical step, resulting in budgeting errors.

Exploring Financing Options

While online calculators are useful, securing personalized quotes from lenders is essential. Here's a breakdown of your options:

- Banks and Credit Unions: Traditional lenders offering competitive rates, especially for farmers with good credit. They often provide personalized service but might demand more paperwork.

- Equipment Dealers: Tractor dealerships frequently partner with financiers, sometimes offering bundled deals that include maintenance packages.

- Government Programs: Some governments offer agricultural loan programs with potentially lower rates and longer repayment periods. Eligibility criteria may vary, so check your local guidelines.

- Online Lenders: These typically offer a faster application process but might have higher interest rates or less flexible terms.

How do you choose what's best for your situation? Considering your credit history and financial stability is key to unlocking suitable loan options.

Assessing Your Needs: Right Tractor, Right Loan

Choosing the right tractor is paramount to your success. Consider these factors:

- Farm's operational needs: What are your primary tasks and challenges?

- Sustainable practices: Will the tractor support eco-friendly farming techniques?

- Tractor features: Size, power, and specific features needed for your farming style.

- Return on Investment (ROI): Include potential environmental benefits in your ROI calculations.

Failing to thoroughly assess your needs might lead to unnecessary costs or purchasing a less-than-ideal tractor. Many farmers struggle because of overspending or underestimating their true needs.

Negotiating with Lenders

Negotiating is key to securing the best terms. Don't be afraid to shop around and use competing quotes to leverage better offers.

- Strong Credit Score: A higher credit score improves your chances of favorable terms.

- Substantial Down Payment: A larger down payment might qualify you for lower interest rates.

- Well-Defined Business Plan: Demonstrating financial stability strengthens your negotiating position.

Successfully negotiating a loan often involves careful planning and preparation. Don’t be afraid to negotiate—it could save you thousands of dollars.

Long-Term Financial Planning and Sustainability

Sustainable farming isn't just environmentally responsible; it can be financially resilient. Consider:

- Fuel efficiency: Lower fuel consumption can lead to cost savings.

- Reduced emissions: Potentially opening opportunities for carbon credit markets.

- Improved precision farming: Reducing waste and increasing efficiency.

Integrating these factors into your financial planning secures long-term sustainability and profitability.

Resources and Further Reading

Tractor Financing Resources

This guide provides a solid foundation; however, always seek professional financial advice tailored to your specific circumstances. Remember, financing is crucial, but selecting the right tractor for your farm is equally important!